Table of Links

3 Background

4 System Model and 4.1 System Participants

4.2 Leverage Staking with LSDs

7.1 stETH Price Deviation and Terra Crash

7.2 Cascading Liquidation and User Behaviors

8 Stress Testing

8.1 Motivation and 8.2 Simulation

9 Discussion and Future Research Directions

A. Aave Parameter Configuration

B. Generalized Formalization For Leverage Staking

C. Leverage Staking Detection Algorithm

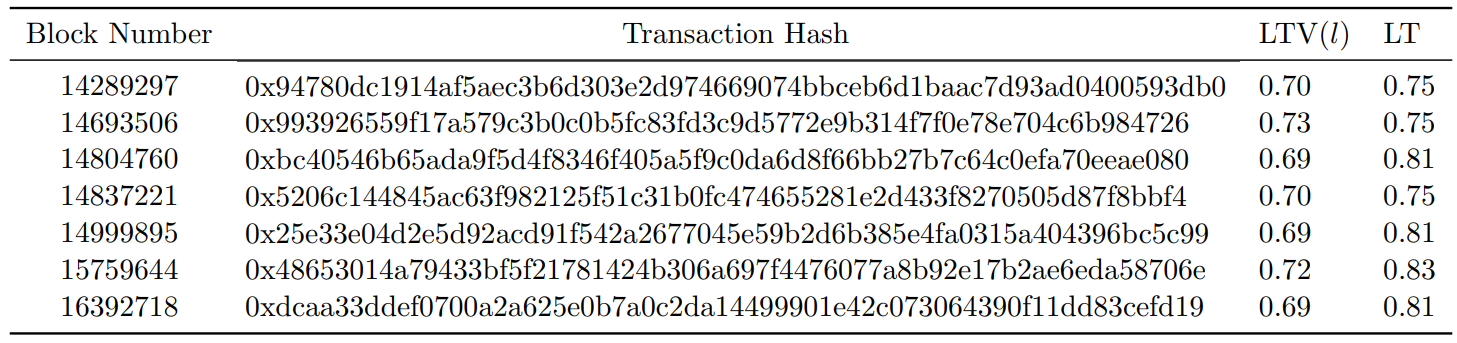

A Aave Parameter Configuration

Table 3 depicts the historical changes of Aave parameter configurations. We crawl the collateralConfigurationChanged events for Aave V2 lending pool.

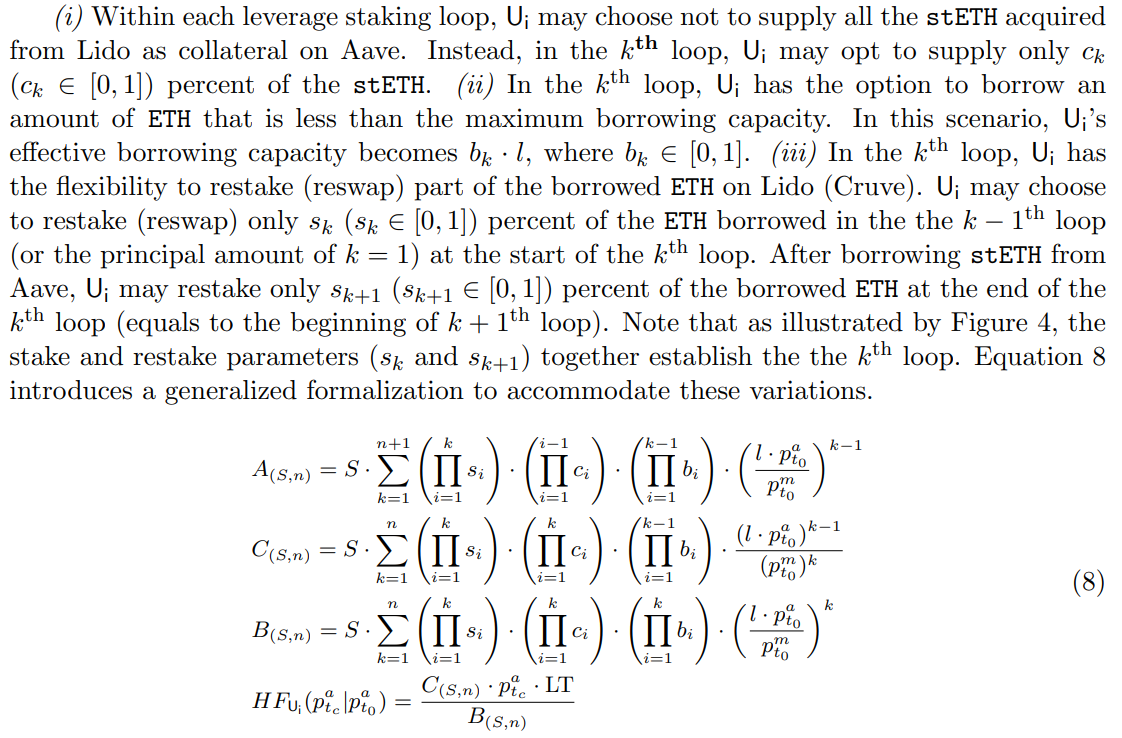

B Generalized Formalization For Leverage Staking

B.1 Generalized Formalization

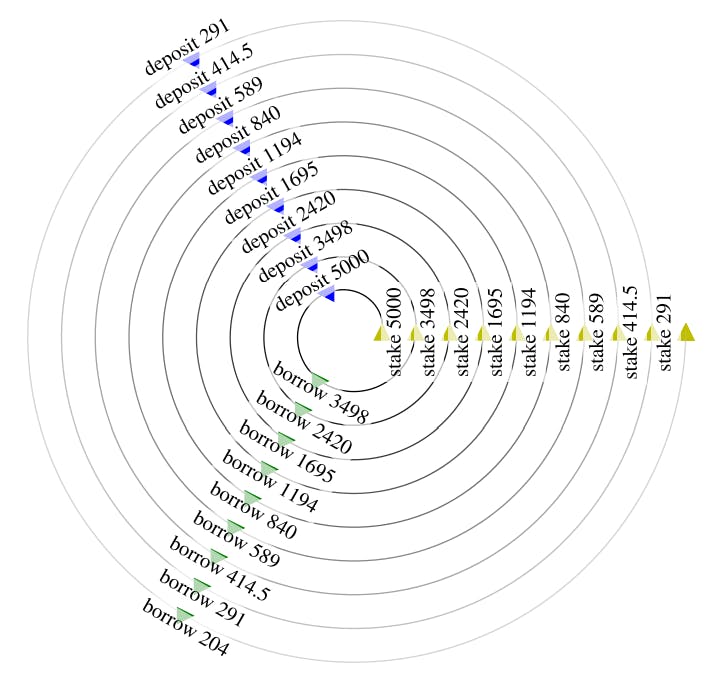

In addition to the standardized cases discussed in Section 5, real-world leverage lending situations can exhibit substantial variation among users. Specifically, we delineate the following variations using the direct leverage staking strategy as an example.

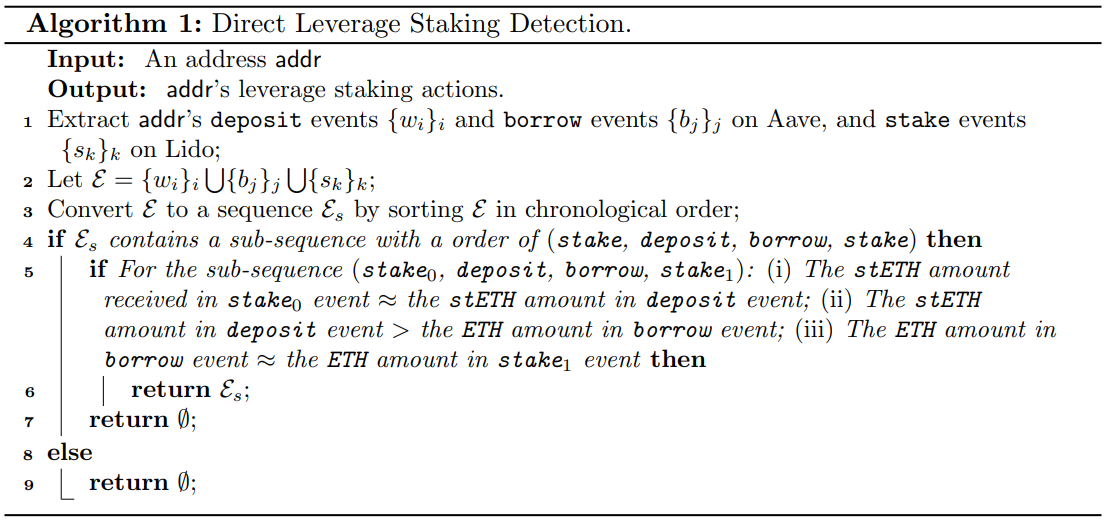

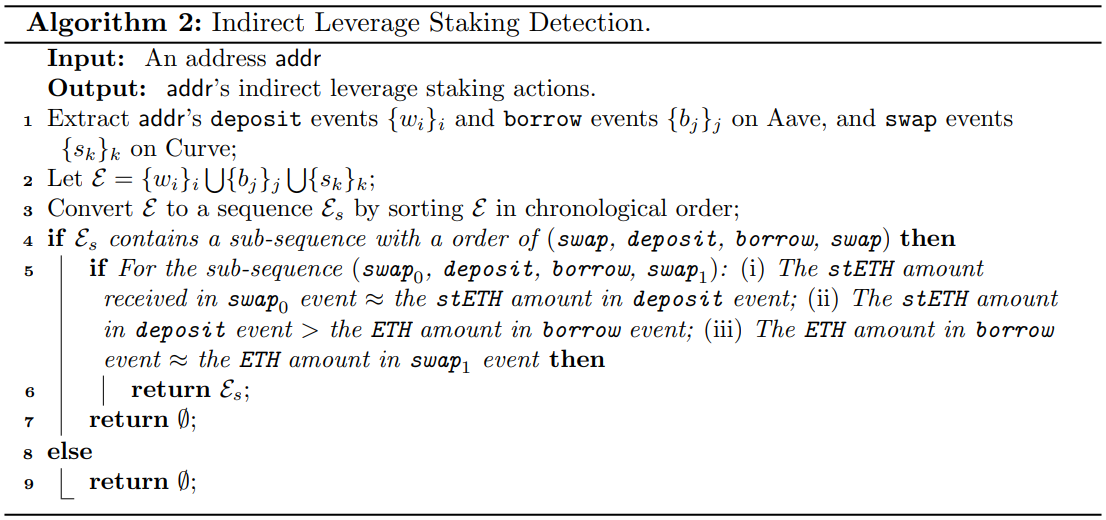

C Leverage Staking Detection Algorithm

Algorithms 1 and 2 depict the heuristics used to detect addresses that have performed direct and indirect leverage staking respectively.

Authors:

(1) Xihan Xiong, Imperial College London, UK;

(2) Zhipeng Wang, Imperial College London, UK;

(3) Xi Chen, University of Sussex, UK;

(4) William Knottenbelt, Imperial College London, UK;

(5) Michael Huth, Imperial College London, UK.

This paper is available on arxiv under CC BY 4.0 DEED license.