How Lending Pools and Leverage Staking Are Shaping DeFi’s Risk Landscape

10 Jul 2025

Explore Aave V2 parameter changes and discover how algorithms detect direct and indirect leverage staking strategies on-chain.

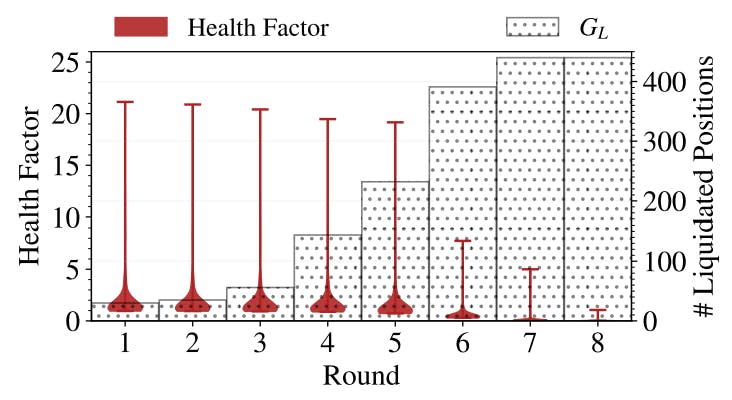

Why Leverage Staking Is Riskier Than It Looks

10 Jul 2025

Simulations reveal how leverage staking in LSD protocols can amplify risks, triggering market-wide liquidations and threatening ecosystem stability.

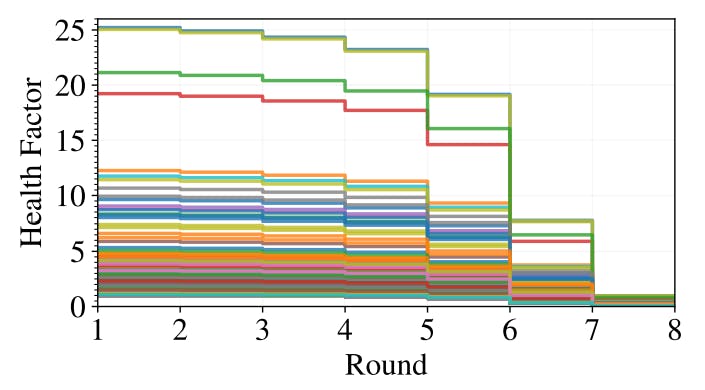

The Hidden Contagion Risks of Leveraged Crypto Lending

9 Jul 2025

Simulated stress tests show how stETH devaluation on Aave can trigger massive liquidations, risking DeFi stability through leverage staking positions.

What Happens When DeFi Leverage Goes Wrong

9 Jul 2025

User actions during stETH declines can trigger liquidations, deepen price crashes, and destabilize DeFi markets via feedback loops.

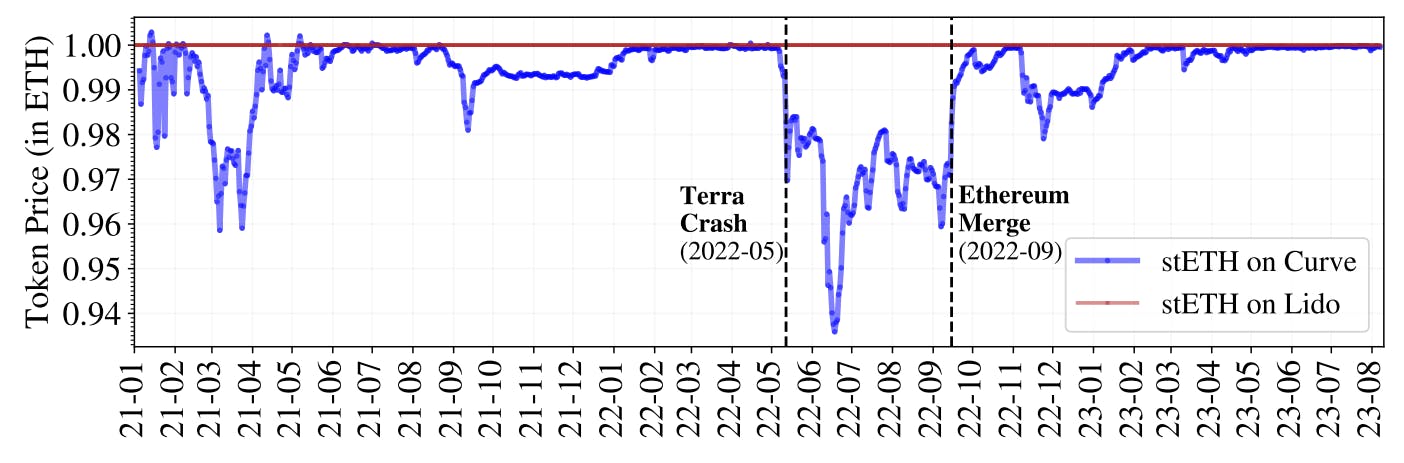

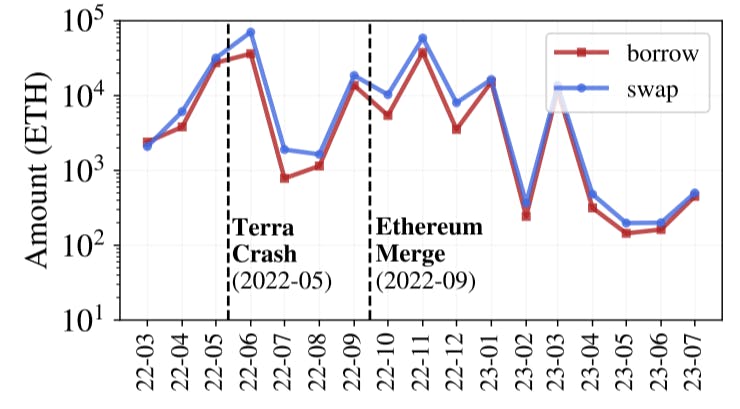

How Terra’s Collapse Triggered a Staking Liquidity Crisis

9 Jul 2025

How the Terra collapse triggered stETH price drops, leveraged staking risks, and cascading liquidations across Ethereum’s LSD ecosystem.

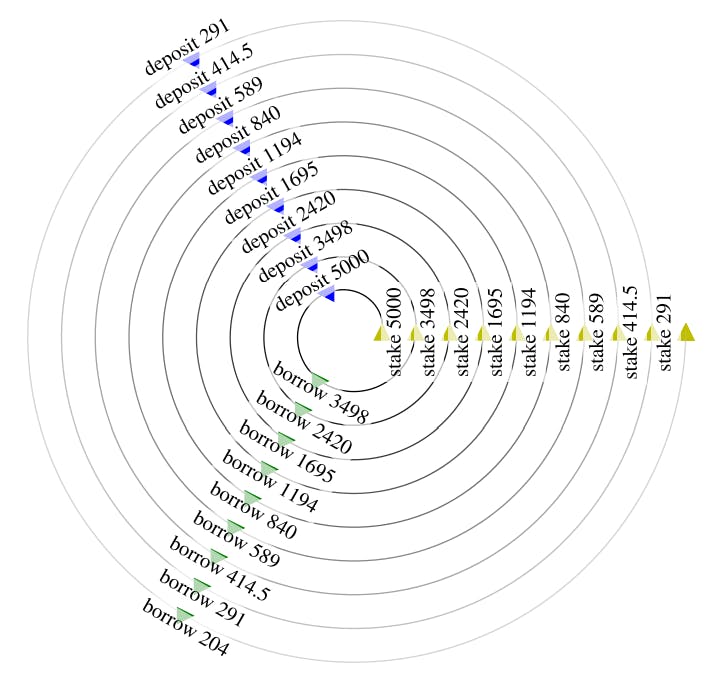

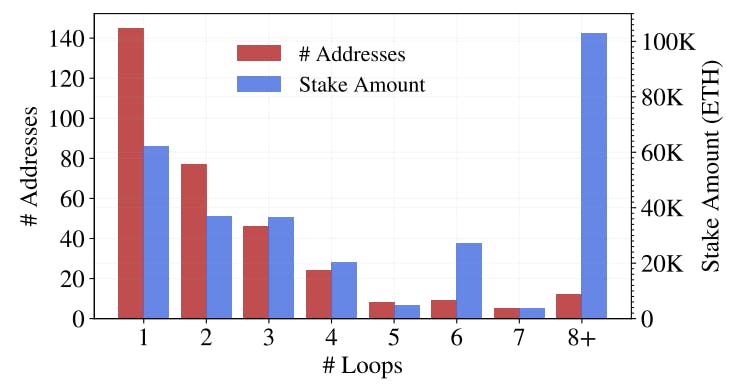

How Ethereum Whales Use Loops to Leverage Stake Millions in ETH

8 Jul 2025

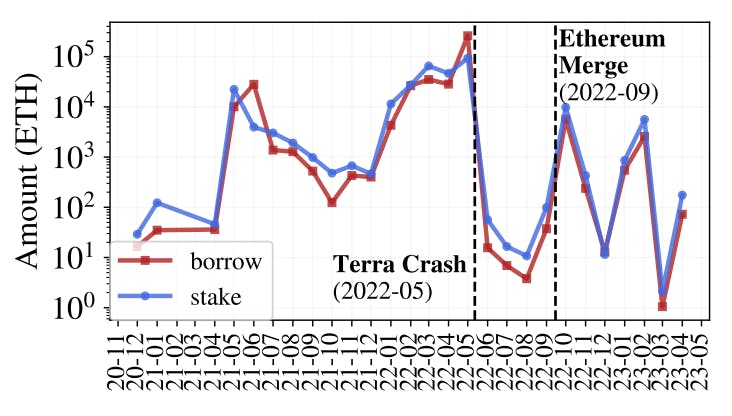

Empirical analysis of leverage staking on Aave, Lido, and Curve shows loops, APR gains, and ETH strategies across 963 days of blockchain activity.

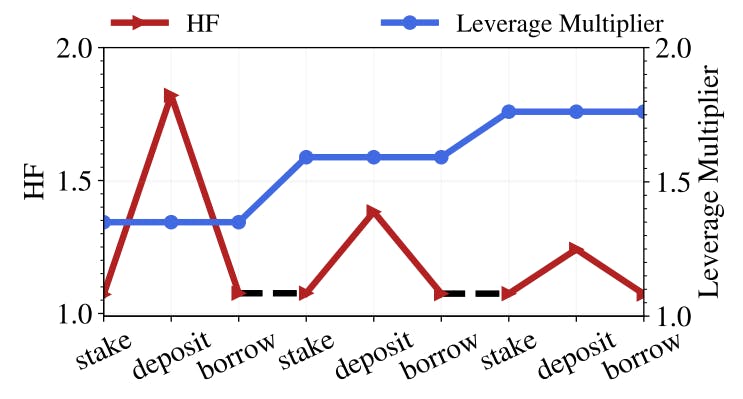

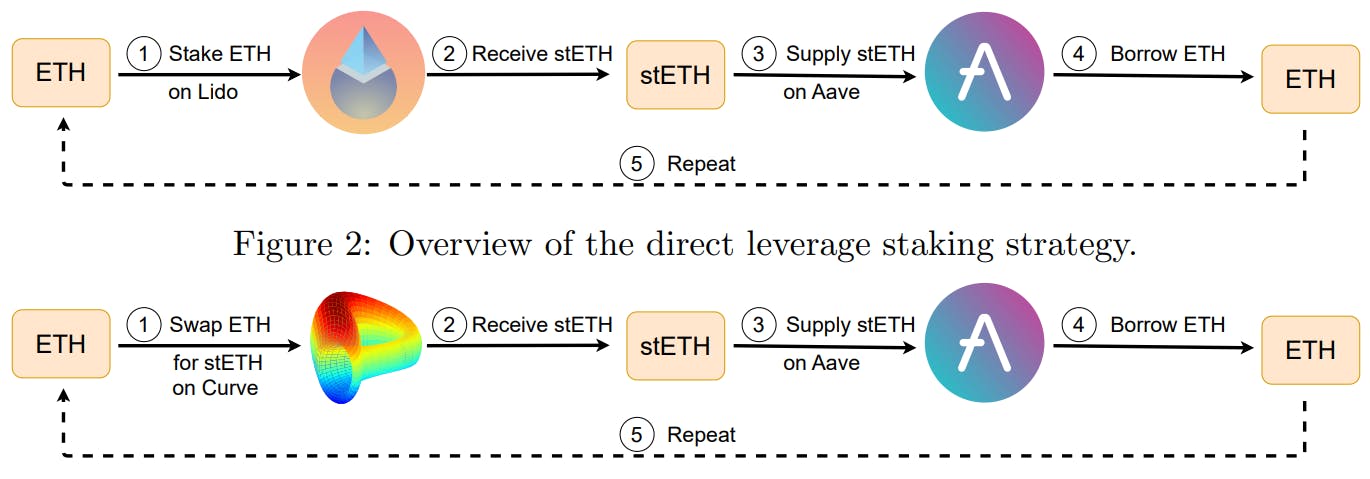

The Risks and Realities of Leverage Staking

8 Jul 2025

Explore the mechanics, variations, and formal analysis of leverage staking strategies across real-world DeFi scenarios.

Comparative Analysis of Leverage Borrowing and Leverage Staking in Ethereum’s LSD Ecosystem

8 Jul 2025

Compare leverage staking and borrowing strategies using LSDs like stETH in Ethereum’s DeFi landscape, including risks, returns, and recursion.

How to Stake ETH and Earn Rewards Without Locking Your Funds

8 Jul 2025

Explore Ethereum staking options—solo, SaaS, pooled, and CEX—and learn how LSDs like stETH make ETH staking liquid and tradable.