Table of Links

3 Background

4 System Model and 4.1 System Participants

4.2 Leverage Staking with LSDs

7.1 stETH Price Deviation and Terra Crash

7.2 Cascading Liquidation and User Behaviors

8 Stress Testing

8.1 Motivation and 8.2 Simulation

9 Discussion and Future Research Directions

A. Aave Parameter Configuration

B. Generalized Formalization For Leverage Staking

C. Leverage Staking Detection Algorithm

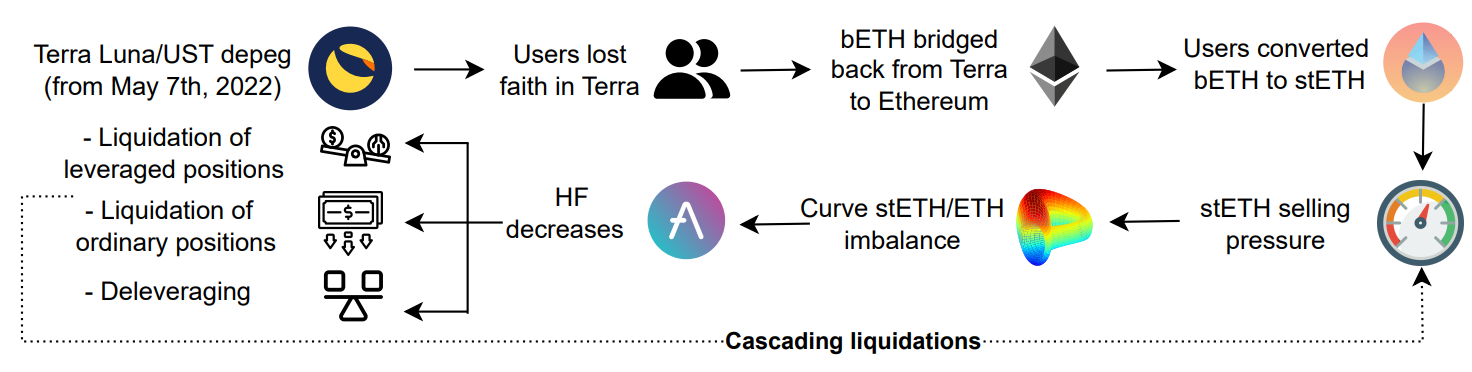

7 Cascading Liquidation

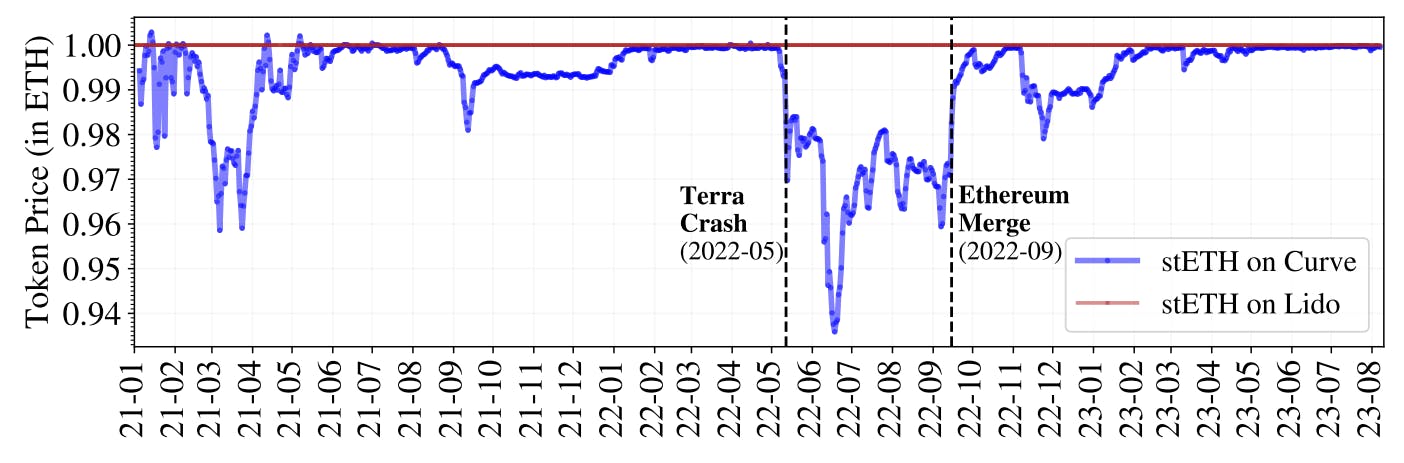

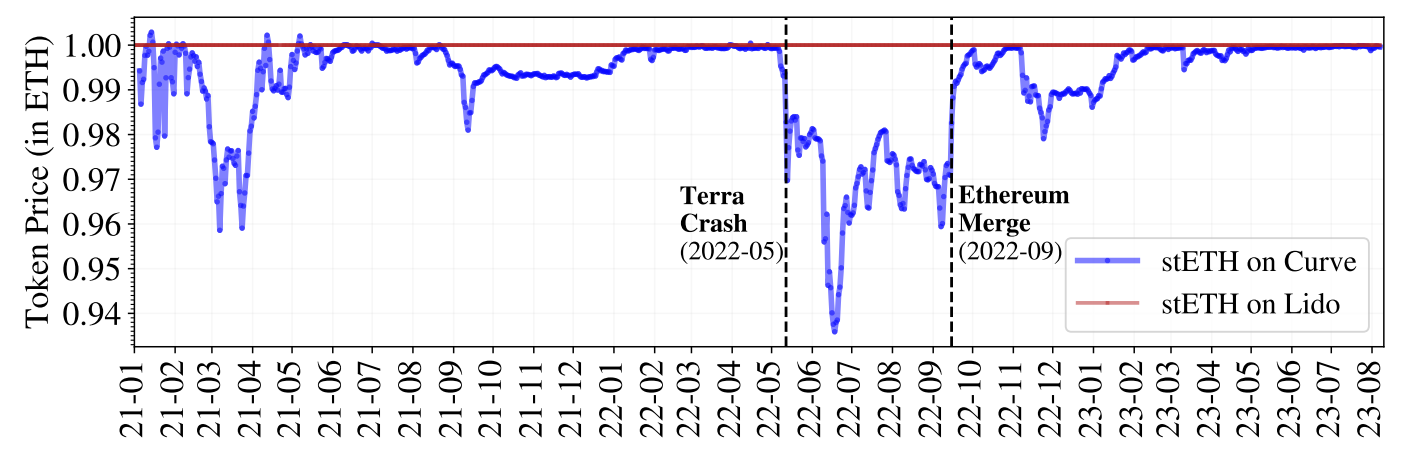

In this section, we offer an overview of the stETH price deviation in relation to the Terra crash incident. We illustrate how the stETH price can potentially lead to liquidation cascades within the LSD ecosystem, especially in the context of leverage staking.

7.1 stETH Price Deviation and Terra Crash

As a rebasing LSD, stETH changes its token supply to distribute rewards to stakers (see Section 3.4). As such, the stETH to ETH price in the primary market (i.e., Lido) is 1. While stETH is not required to trade on par with ETH in the secondary market (e.g., Curve), the price is anticipated to converge to 1. Our empirical data show that stETH did maintain a loose peg to ETH for most of its history. However, the stETH price began to drop from May 12, 2022, reaching its lowest point of 0.931 on May 18, 2022 (see Figure 17).

The stETH price decline can date back to the UST/LUNA depeg. The Terra collapse instilled fear and triggered selling pressure throughout the market [27, 28]. Specifically, following the UST/LUNA depeg incident between May 7 to 16, investors grew concerned about the security and stability of the Terra network. Given the prevailing bearish sentiment, investors moved to bridge back bETH (a wrapped version of stETH on Terra) from Terra to Ethereum via the Wormhole contract. Our data show that 614k bETH was bridged to Ethereum, with a remarkable 98% of these bETH converted back to stETH. This mass conversion reflects the widespread desire to exit Terra-based staking assets. Subsequently, the secondary market experienced significant selling pressure, primarily from institutions such as Celsius. This imbalance in the Curve stETH–ETH pool contributed to the price decline of stETH.

Authors:

(1) Xihan Xiong, Imperial College London, UK;

(2) Zhipeng Wang, Imperial College London, UK;

(3) Xi Chen, University of Sussex, UK;

(4) William Knottenbelt, Imperial College London, UK;

(5) Michael Huth, Imperial College London, UK.

This paper is available on arxiv under CC BY 4.0 DEED license.