Table of Links

3 Background

4 System Model and 4.1 System Participants

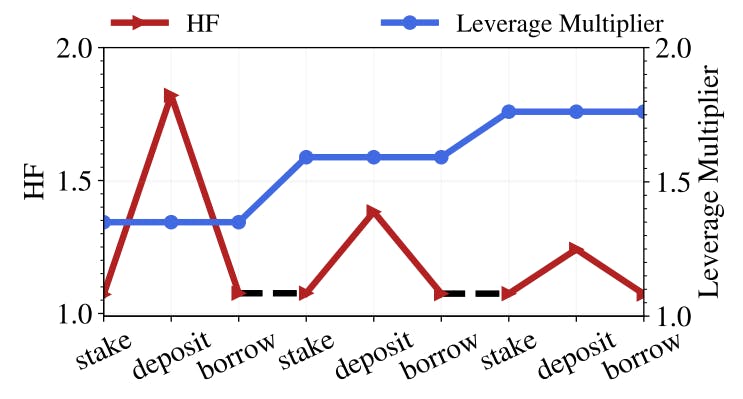

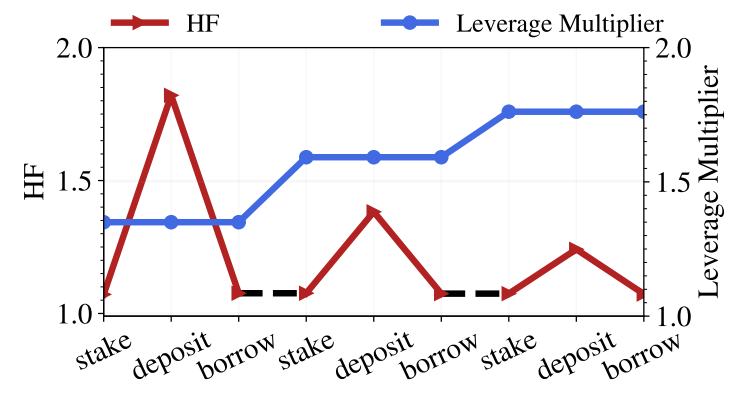

4.2 Leverage Staking with LSDs

7.1 stETH Price Deviation and Terra Crash

7.2 Cascading Liquidation and User Behaviors

8 Stress Testing

8.1 Motivation and 8.2 Simulation

9 Discussion and Future Research Directions

A. Aave Parameter Configuration

B. Generalized Formalization For Leverage Staking

C. Leverage Staking Detection Algorithm

7.2 Cascading Liquidation and User Behaviors

The decline in stETH price may trigger liquidation cascades within the LSD ecosystem, especially in the context of leverage staking (see Figure 18). Specifically, the decline in stETH price reduces the HFs of stETH collateralized borrowing positions on Aave, potentially leading to liquidations. In response to liquidations, users with leverage staking positions can either take no action and undergo liquidation, or choose to deleverage their positions.

On the one hand, users with leverage staking positions may take no action when their HFs approach the critical threshold of 1. In this case, their collateralized stETH might be liquidated. The liquidators repay ETH to acquire stETH, with the liquidation amount being amplified by LevM(S,n) . Subsequently, a significant amount of stETH is sold in the Curve pool, contributing to additional selling pressure on stETH (see Figure 18). This extensive selling further imbalances the Curve stETH–ETH pool, resulting in a further decline in stETH price. Consequently, an increasing number of positions, including both leverage staking and ordinary positions, are vulnerable to liquidation as a result of declining HFs.

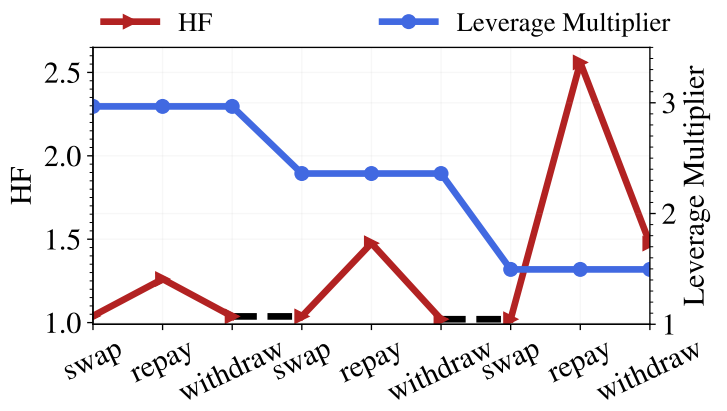

On the other hand, users can choose to deleverage their positions on Aave to restore HFs. Assuming Ui has executed a direct or indirect leverage staking strategy with n loops, Ui can initiate a deleveraging process with the following steps. (i) Ui executes a swap to convert stETH into ETH within the Curve stETH–ETH pool. (ii) The received ETH is then used to repay the ETH borrowed in the n th loop. (iii) Ui then withdraws the stETH that was supplied in the n th loop from Aave and continues converting it into ETH using the Curve pool. This “swap-repay-withdraw” process is repeated as necessary to deleverage the position and restore HF until it remains above 1.

Taking address 0xD2...701 as an example, the overall trend of HF and LevM(S,n) during the deleveraging process (see Figure 20) exhibit a remarkable degree of symmetry when compared to those observed in the leveraging process (Figure 19). With each repay action, the HF of the address increases, as indicated by the red line, while the leverage multiplier decreases, as shown by the blue line. This symmetrical trend illustrates the correlation between repaying debt and improving HF, which consequently reduces LevM(S,n) .

During the period from May 8, 2022 to May 18, 2022, i.e., the first ten days after the Terra crash (Figure 17), we observed 13 users actively deleveraging their direct leverage staking positions and 5 users deleveraging their indirect leverage staking positions. This activity resulted in a total debt repayment of 74,983.6 ETH and 61,085.5 ETH respectively. However, it is important to note that even if a user manages to avoid liquidation by deleveraging, the additional selling pressure generated by the swap transactions on Curve can still intensify the decline in stETH price. This decline may potentially make other leverage staking and ordinary positions more susceptible to liquidation. Such ripple effect may increase market instability and affect a broader range of participants beyond those directly engaged in deleveraging.

To summarize, users with leverage staking positions can take various actions to respond to potential liquidations. Regardless of their choices, these actions may contribute to additional selling pressure on stETH, further exacerbating price declines and liquidation cascades. This dynamic underscores the interconnection of leverage staking and the broader market ecosystem. In the following section, we will conduct stress tests to evaluate such risks.

Authors:

(1) Xihan Xiong, Imperial College London, UK;

(2) Zhipeng Wang, Imperial College London, UK;

(3) Xi Chen, University of Sussex, UK;

(4) William Knottenbelt, Imperial College London, UK;

(5) Michael Huth, Imperial College London, UK.

This paper is available on arxiv under CC BY 4.0 DEED license.