Table of Links

3 Background

4 System Model and 4.1 System Participants

4.2 Leverage Staking with LSDs

7.1 stETH Price Deviation and Terra Crash

7.2 Cascading Liquidation and User Behaviors

8 Stress Testing

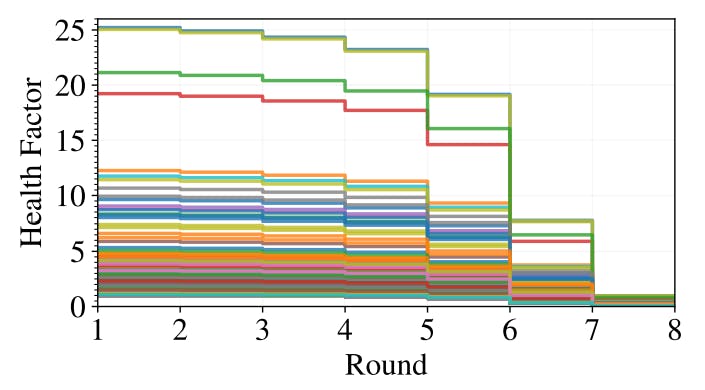

8.1 Motivation and 8.2 Simulation

9 Discussion and Future Research Directions

A. Aave Parameter Configuration

B. Generalized Formalization For Leverage Staking

C. Leverage Staking Detection Algorithm

9 Discussion and Future Research Directions

Our comprehensive stress tests on the Lido-Aave-Curve LSD ecosystem reveal critical vulnerabilities and dynamic interplays under extreme conditions of significant stETH devaluation. These simulations illustrate that leverage staking strategies, while innovative, expose the market to heightened risks. The presence of leverage staking significantly escalates the risk of cascading liquidations within the LSD ecosystem. This finding underlines a crucial concern: systemic risk is exacerbated not only through direct liquidations but also via the market pressures these actions generate. The selling pressure on stETH, driven by both liquidations and deleveraging actions, can trigger a ripple effect across the system, further depressing stETH prices and adversely impacting the financial stability of broader market participants (such as ordinary users). Therefore, it is crucial to strike a balance between leveraging opportunities for higher returns and the potential for destabilization in LSD ecosystems.

Building upon these insights, future research can pursue several avenues. A crucial direction is the development of refined models that simulate a broader range of conditions, incorporating more granular behaviors of market participants and liquidity variations. This could lead to more robust parameterization of platforms such as Aave, similar to the ‘safe parameterization’ design used in traditional finance, which aims to mitigate risks without stifling innovation. Additionally, exploring new regulatory frameworks tailored to LSDs could help prevent the systemic shocks observed in our simulations. By integrating advanced risk management strategies and regulatory innovations, future research can contribute to creating a more resilient LSD ecosystem. This involves a holistic approach to understanding the interdependencies and collective behaviors that define these platforms.

10 Conclusion

This paper systematically studies the leverage staking strategy with LSDs. In the analytical section, we propose a formal model to capture the direct and indirect leverage staking strategy within the Lido–Aave–Curve LSD ecosystem. In the empirical section, we introduce heuristics to identify historical leverage staking positions and assess factors such as leverage amounts, loops, multipliers, and APRs. Our findings indicate that the majority of leverage staking positions yield an APR higher than the APR of conventional staking, underscoring their high-return nature. However, recognizing the associated risks, we also conduct stress tests to simulate various extreme scenarios. These tests reveal that leverage staking significantly increases the risk of cascading liquidations within the LSD ecosystem because it triggers additional selling pressures during liquidations and deleveraging. Furthermore, our simulation suggests that leverage staking not only intensifies the risk profile of individual portfolios but also contributes to broader systemic risks as it exacerbates the liquidation of ordinary positions. We hope our research inspires academic researchers and protocol developers to create robust risk assessment methods and safe parameterizations that safeguard all stakeholders within the LSD ecosystem.

References

[1] G. Wood, “Ethereum: A secure decentralised generalised transaction ledger,” Ethereum project yellow paper, vol. 151, pp. 1–32, 2014.

[2] D. Grandjean, L. Heimbach, and R. Wattenhofer, “Ethereum proof-of-stake consensus layer: Participation and decentralization,” arXiv preprint arXiv:2306.10777, 2023.

[3] C. Schwarz-Schilling, J. Neu, B. Monnot, A. Asgaonkar, E. N. Tas, and D. Tse, “Three attacks on proof-of-stake ethereum,” in International Conference on Financial Cryptography and Data Security, pp. 560–576, Springer, 2022.

[4] S. Agrawal, J. Neu, E. N. Tas, and D. Zindros, “Proofs of proof-of-stake with sublinear complexity,” arXiv preprint arXiv:2209.08673, 2022.

[5] W. Tang and D. D. Yao, “Transaction fee mechanism for proof-of-stake protocol,” arXiv preprint arXiv:2308.13881, 2023.

[6] V. Buterin, D. Hernandez, T. Kamphefner, K. Pham, Z. Qiao, D. Ryan, J. Sin, Y. Wang, and Y. X. Zhang, “Combining ghost and casper,” arXiv preprint arXiv:2003.03052, 2020.

[7] J. Neu, E. N. Tas, and D. Tse, “Ebb-and-flow protocols: A resolution of the availabilityfinality dilemma,” in 2021 IEEE Symposium on Security and Privacy (SP), pp. 446–465, IEEE, 2021.

[8] L. W. Cong, Z. He, and K. Tang, “Staking, token pricing, and crypto carry,” Available at SSRN 4059460, 2022.

[9] T. Chitra, “Competitive equilibria between staking and on-chain lending,” 2021.

[10] A. Tzinas and D. Zindros, “The principal–agent problem in liquid staking,” Cryptology ePrint Archive, 2023.

[11] S. Scharnowski and H. Jahanshahloo, “The economics of liquid staking derivatives: Basis determinants and price discovery,” Available at SSRN 4180341, 2023.

[12] T. N. Cintra and M. P. Holloway, “Detecting depegs: Towards safer passive liquidity provision on curve finance,” arXiv preprint arXiv:2306.10612, 2023.

[13] L. Heimbach, E. Schertenleib, and R. Wattenhofer, “Defi lending during the merge,” in 5th Conference on Advances in Financial Technologies, 2023.

[14] Z. Wang, K. Qin, D. V. Minh, and A. Gervais, “Speculative multipliers on defi: Quantifying on-chain leverage risks,” Financial Cryptography and Data Security, 2022.

[15] S. Nakamoto, “Bitcoin: A peer-to-peer electronic cash system,” 2008. Available at: https://bitcoin.org/bitcoin.pdf.

[16] V. Buterin et al., “Ethereum white paper,” GitHub repository, vol. 1, pp. 22–23, 2013.

[17] S. Werner, D. Perez, L. Gudgeon, A. Klages-Mundt, D. Harz, and W. Knottenbelt, “Sok: Decentralized finance (defi),” in Proceedings of the 4th ACM Conference on Advances in Financial Technologies, pp. 30–46, 2022.

[18] P. Daian, R. Pass, and E. Shi, “Snow white: Robustly reconfigurable consensus and applications to provably secure proof of stake,” in International Conference on Financial Cryptography and Data Security, pp. 23–41, Springer, 2019.

[19] P. Gaˇzi, A. Kiayias, and D. Zindros, “Proof-of-stake sidechains,” in 2019 IEEE Symposium on Security and Privacy (SP), pp. 139–156, IEEE, 2019.

[20] A. Kiayias, A. Russell, B. David, and R. Oliynykov, “Ouroboros: A provably secure proof-of-stake blockchain protocol,” in Annual International Cryptology Conference, pp. 357–388, Springer, 2017.

[21] S. Bano, A. Sonnino, M. Al-Bassam, S. Azouvi, P. McCorry, S. Meiklejohn, and G. Danezis, “Sok: Consensus in the age of blockchains,” in Proceedings of the 1st ACM Conference on Advances in Financial Technologies, pp. 183–198, 2019.

[22] “The Merge,” 2023. Available at: https://ethereum.org/en/roadmap/merge/.

[23] P. Daian, S. Goldfeder, T. Kell, Y. Li, X. Zhao, I. Bentov, L. Breidenbach, and A. Juels, “Flash boys 2.0: Frontrunning in decentralized exchanges, miner extractable value, and consensus instability,” in 2020 IEEE Symposium on Security and Privacy (SP), pp. 910– 927, IEEE, 2020.

[24] Y. Liu, Y. Lu, K. Nayak, F. Zhang, L. Zhang, and Y. Zhao, “Empirical analysis of eip-1559: Transaction fees, waiting times, and consensus security,” in Proceedings of the 2022 ACM SIGSAC Conference on Computer and Communications Security, pp. 2099– 2113, 2022.

[25] Ethereum.org, “The history of ethereum,” 2023. Available at: https://ethereum.org/ en/history/.

[26] “Lido tokens integration guide,” 2023. Available at: https://docs.lido.fi/guides/ lido-tokens-integration-guide.

[27] J. Liu, I. Makarov, and A. Schoar, “Anatomy of a run: The terra luna crash,” tech. rep., National Bureau of Economic Research, 2023.

[28] S. Lee, J. Lee, and Y. Lee, “Dissecting the terra-luna crash: Evidence from the spillover effect and information flow,” Finance Research Letters, vol. 53, p. 103590, 2023.

Authors:

(1) Xihan Xiong, Imperial College London, UK;

(2) Zhipeng Wang, Imperial College London, UK;

(3) Xi Chen, University of Sussex, UK;

(4) William Knottenbelt, Imperial College London, UK;

(5) Michael Huth, Imperial College London, UK.

This paper is available on arxiv under CC BY 4.0 DEED license.